What is e-Invoice?

An e-Invoice is a digital representation of a transaction between a supplier and a buyer. It contains the same essential information as a traditional document, and is meant to digitalize business efficiency and increases tax compliance.

For more information, visit https://www.hasil.gov.my/en/e-invoice/.

In compliance with Lembaga Hasil Dalam Negeri (LHDN) e-Invoice initiative, gradual on boarding of Unifi customers to e-invoicing with LHDN begins on 1 July 2025.

Why e-Invoice?

Facilitate efficient tax filing

Seamless system integration for efficient and accurate tax reporting

Streamline operational efficiency

Improve tax filing efficiency for taxpayers with digitalized expenses records in the annual income tax return form.

DIGITALIZED tax and financial reporting

Standardizing financial reporting and processes, aligning with industry standards.

HOW TO GET A VALIDATED E-INVOICE FOR YOUR UNIFI BILLS?

STEP

1

Provide your details for e-Invoicing

Click on “Get Started Now,” and ensure you have your Tax Identification Number (TIN) ready.

STEP

2

Receive validated e-Invoice documents via email

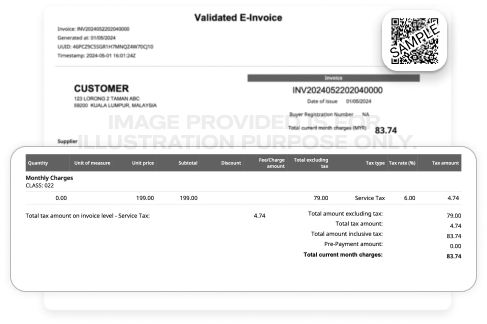

Upon successful onboarding to our e-Invoicing journey with LHDN, you'll receive a validated e-Invoice document with a QR code.

STEP

3

MyInvois Portal

Please log in to your IRB/LHDN “MyInvois Portal” dashboard to verify the receipt of your validated e-Invoice documents from TM/Unifi.

Difference between

an e-invoice and TM/UNIFI invoice

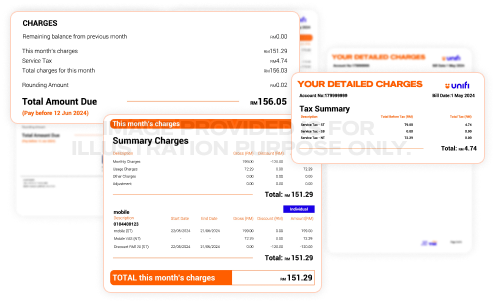

Below are samples of validated e-Invoices by IRBM / LHDN and your monthly TM/Unifi bill statement. An LHDN e-Invoice includes a QR code as proof of validation.